Realized Loss Journal Entry . for realized loss: Select the date for the. realized income or losses refer to profits or losses from completed transactions. creating journal entries suppose mark to market shows a $90,000 investment has dropped by $10,000. realized losses are those incurred losses from a transaction that yielded a market value much lower than the original value. other journal entry examples. the full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income. To record realized foreign exchange loss, follow the steps below: The following answer from quickbooks support user jpaperman on the. realized losses can be categorized into several types, each with distinct characteristics and implications.

from help.tamaracinc.com

for realized loss: The following answer from quickbooks support user jpaperman on the. creating journal entries suppose mark to market shows a $90,000 investment has dropped by $10,000. other journal entry examples. Select the date for the. To record realized foreign exchange loss, follow the steps below: the full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income. realized losses are those incurred losses from a transaction that yielded a market value much lower than the original value. realized income or losses refer to profits or losses from completed transactions. realized losses can be categorized into several types, each with distinct characteristics and implications.

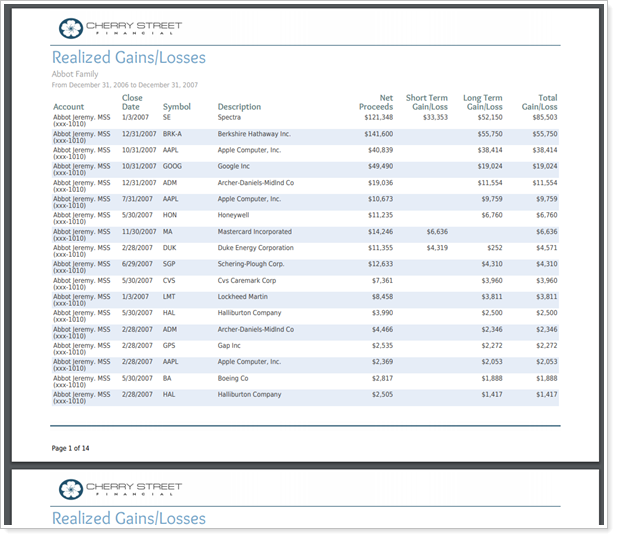

Realized Gains and Losses Report

Realized Loss Journal Entry Select the date for the. the full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income. To record realized foreign exchange loss, follow the steps below: realized income or losses refer to profits or losses from completed transactions. The following answer from quickbooks support user jpaperman on the. creating journal entries suppose mark to market shows a $90,000 investment has dropped by $10,000. Select the date for the. realized losses can be categorized into several types, each with distinct characteristics and implications. for realized loss: other journal entry examples. realized losses are those incurred losses from a transaction that yielded a market value much lower than the original value.

From www.chegg.com

Solved SHOW work a. Prepare the journal entry to record the Realized Loss Journal Entry creating journal entries suppose mark to market shows a $90,000 investment has dropped by $10,000. To record realized foreign exchange loss, follow the steps below: realized losses are those incurred losses from a transaction that yielded a market value much lower than the original value. realized income or losses refer to profits or losses from completed transactions.. Realized Loss Journal Entry.

From www.geeksforgeeks.org

Trading and Profit and Loss Account Opening Journal Entries Realized Loss Journal Entry realized losses can be categorized into several types, each with distinct characteristics and implications. realized income or losses refer to profits or losses from completed transactions. The following answer from quickbooks support user jpaperman on the. other journal entry examples. creating journal entries suppose mark to market shows a $90,000 investment has dropped by $10,000. Select. Realized Loss Journal Entry.

From blog.treezsoft.com

realized gain and loss Step by step guide to record realized gains Realized Loss Journal Entry realized losses can be categorized into several types, each with distinct characteristics and implications. Select the date for the. creating journal entries suppose mark to market shows a $90,000 investment has dropped by $10,000. the full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income. To. Realized Loss Journal Entry.

From www.thevistaacademy.com

Journal Entry of Goods loss by fire in Accounting Realized Loss Journal Entry To record realized foreign exchange loss, follow the steps below: realized losses are those incurred losses from a transaction that yielded a market value much lower than the original value. realized income or losses refer to profits or losses from completed transactions. realized losses can be categorized into several types, each with distinct characteristics and implications. . Realized Loss Journal Entry.

From www.slideserve.com

PPT Chapter 10 PowerPoint Presentation, free download ID33049 Realized Loss Journal Entry for realized loss: creating journal entries suppose mark to market shows a $90,000 investment has dropped by $10,000. The following answer from quickbooks support user jpaperman on the. the full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income. Select the date for the. realized. Realized Loss Journal Entry.

From www.youtube.com

Excel How to Build Realized Foreign Exchange Gain / Loss Calculation Realized Loss Journal Entry Select the date for the. creating journal entries suppose mark to market shows a $90,000 investment has dropped by $10,000. for realized loss: the full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income. realized income or losses refer to profits or losses from completed. Realized Loss Journal Entry.

From jaseqivillanueva.blogspot.com

Impairment Loss Journal Entry JaseqiVillanueva Realized Loss Journal Entry the full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income. realized losses are those incurred losses from a transaction that yielded a market value much lower than the original value. other journal entry examples. Select the date for the. for realized loss: realized. Realized Loss Journal Entry.

From www.youtube.com

TRANSACTIONS SALES, RECEIPT AND REALIZED FX GAIN LOSS Realized Loss Journal Entry realized income or losses refer to profits or losses from completed transactions. To record realized foreign exchange loss, follow the steps below: for realized loss: other journal entry examples. the full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income. The following answer from quickbooks. Realized Loss Journal Entry.

From softledger.com

Foreign Currency Revaluation Definition, Process, and Examples Realized Loss Journal Entry Select the date for the. the full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income. realized losses are those incurred losses from a transaction that yielded a market value much lower than the original value. realized income or losses refer to profits or losses from. Realized Loss Journal Entry.

From vasarachelrandall.blogspot.com

Impairment Loss Journal Entry Rachel Randall Realized Loss Journal Entry Select the date for the. realized losses are those incurred losses from a transaction that yielded a market value much lower than the original value. realized losses can be categorized into several types, each with distinct characteristics and implications. To record realized foreign exchange loss, follow the steps below: creating journal entries suppose mark to market shows. Realized Loss Journal Entry.

From help.tamaracinc.com

Realized Gains and Losses Report Realized Loss Journal Entry realized income or losses refer to profits or losses from completed transactions. creating journal entries suppose mark to market shows a $90,000 investment has dropped by $10,000. realized losses can be categorized into several types, each with distinct characteristics and implications. realized losses are those incurred losses from a transaction that yielded a market value much. Realized Loss Journal Entry.

From www.youtube.com

How to make journal Entry for unadjusted Forex Gain/Loss YouTube Realized Loss Journal Entry realized losses are those incurred losses from a transaction that yielded a market value much lower than the original value. for realized loss: Select the date for the. To record realized foreign exchange loss, follow the steps below: The following answer from quickbooks support user jpaperman on the. creating journal entries suppose mark to market shows a. Realized Loss Journal Entry.

From blog.treezsoft.com

realized gain and loss Step by step guide to record realized gains Realized Loss Journal Entry realized losses can be categorized into several types, each with distinct characteristics and implications. realized income or losses refer to profits or losses from completed transactions. the full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income. other journal entry examples. Select the date for. Realized Loss Journal Entry.

From blog.treezsoft.com

realized gain and loss Step by step guide to record realized gains Realized Loss Journal Entry realized losses are those incurred losses from a transaction that yielded a market value much lower than the original value. realized income or losses refer to profits or losses from completed transactions. for realized loss: other journal entry examples. To record realized foreign exchange loss, follow the steps below: realized losses can be categorized into. Realized Loss Journal Entry.

From www.principlesofaccounting.com

Accounting For Asset Exchanges Realized Loss Journal Entry To record realized foreign exchange loss, follow the steps below: the full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income. for realized loss: The following answer from quickbooks support user jpaperman on the. creating journal entries suppose mark to market shows a $90,000 investment has. Realized Loss Journal Entry.

From www.youtube.com

Realised and Unrealised Gain and Loss Example with Journal Entries Realized Loss Journal Entry Select the date for the. To record realized foreign exchange loss, follow the steps below: other journal entry examples. the full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income. for realized loss: realized losses can be categorized into several types, each with distinct characteristics. Realized Loss Journal Entry.

From www.youtube.com

Abnormal loss journal Entry Tally Loss Journal Entry in Books ⚡ Realized Loss Journal Entry realized losses can be categorized into several types, each with distinct characteristics and implications. the full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income. To record realized foreign exchange loss, follow the steps below: The following answer from quickbooks support user jpaperman on the. Select the. Realized Loss Journal Entry.

From exouhvmie.blob.core.windows.net

Journal Entry Unrealized Gain at Tracy Lewis blog Realized Loss Journal Entry realized losses are those incurred losses from a transaction that yielded a market value much lower than the original value. Select the date for the. creating journal entries suppose mark to market shows a $90,000 investment has dropped by $10,000. for realized loss: other journal entry examples. realized losses can be categorized into several types,. Realized Loss Journal Entry.